CAC as a Growth Lever: Why B2B SaaS Should Reframe Customer Acquisition Cost for Strategic Growth

CAC as a Growth Lever: Why B2B SaaS Should Reframe Customer Acquisition Cost for Strategic Growth

CAC as a Growth Lever: Why B2B SaaS Should Reframe Customer Acquisition Cost for Strategic Growth

CAC as a Growth Lever: Why B2B SaaS Should Reframe Customer Acquisition Cost for Strategic Growth

The obsession with low CAC is quietly killing your growth potential.

The obsession with low CAC is quietly killing your growth potential.

The obsession with low CAC is quietly killing your growth potential.

The obsession with low CAC is quietly killing your growth potential.

Dylan Fields

Digital Marketing

Digital Marketing

February 9, 2026

February 9, 2026

11

11

min read

min read

Most B2B finance teams pressure marketing to cut customer acquisition costs. It sounds logical—spend less, improve margins, scale efficiently. But this mindset rests on a dangerous assumption: that cheaper is always better.

The reality? Chasing artificially low CAC doesn't just limit growth—it hands your market share to competitors who are willing to pay what it actually costs to win.

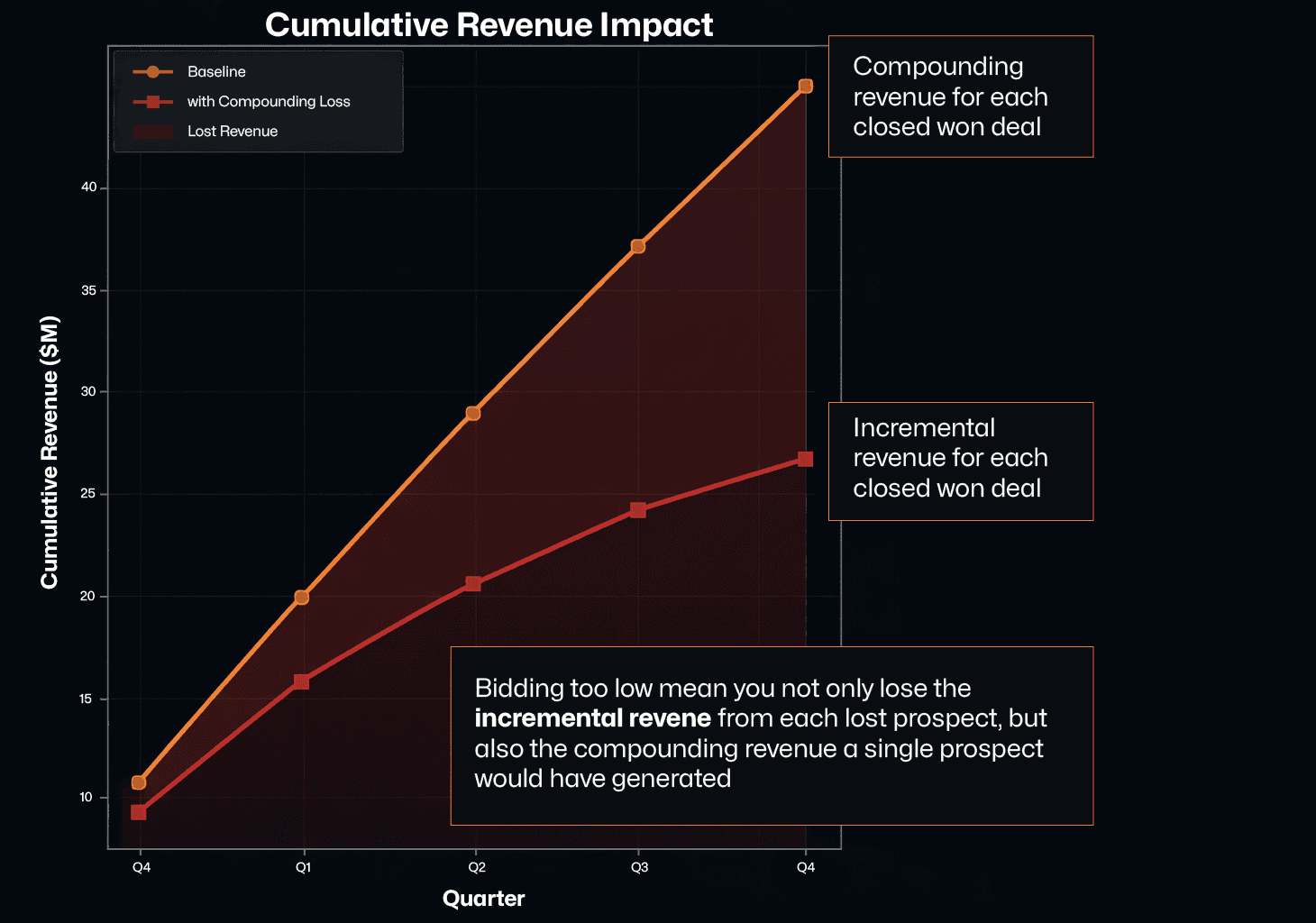

In competitive B2B markets, only about 5% of your total addressable market is actively evaluating solutions at any given time. When you underspend on acquisition, you're not just missing opportunities—you're allowing competitors to capture in-market prospects who won't resurface for years due to long contract cycles and high switching costs.

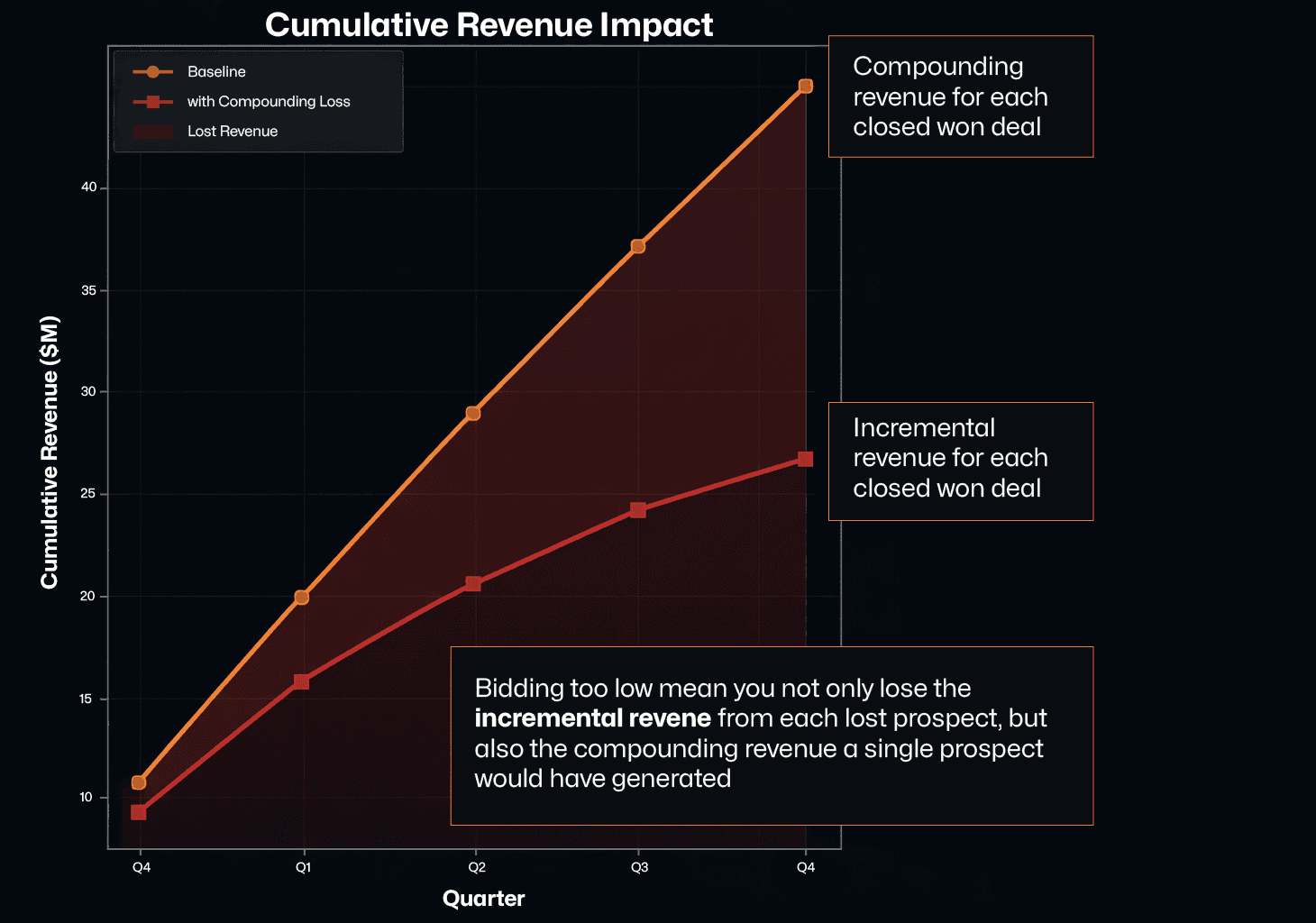

This creates a compounding disadvantage. Every prospect your competitor wins today represents years of lost revenue, reduced market share, and a stronger competitive moat you'll have to overcome later.

The question isn't "How low can we push CAC?" It's "What's the right CAC to maximize sustainable growth and market capture?"

Let's reframe customer acquisition cost from a metric to minimize into a strategic lever for competitive advantage.

Why Low CAC Can Be a Red Flag

If your CAC is significantly lower than your competitors', you might think you've discovered a competitive advantage. More often, it's a warning signal.

In mature, competitive markets, CAC tends to stabilize as competitors copy effective tactics and bid up the cost of high-intent channels. When everyone is competing for the same finite pool of in-market buyers, acquisition costs naturally reach equilibrium.

A suspiciously low CAC usually indicates one of three scenarios:

You've Found a Growth Hack (That Won't Last)

Growth hacks are temporary arbitrage opportunities—untapped channels, underpriced platforms, or novel tactics competitors haven't discovered yet. They work brilliantly until they don't.

The moment your competitors notice your tactic (and they will), they'll replicate it. Costs rise, efficiency drops, and you're back to market equilibrium. Andrew Chen's Law of Shitty Clickthroughs captures this perfectly: every marketing tactic declines in effectiveness over time as the market saturates.

Building a growth strategy on tactics that inherently degrade is a recipe for unsustainable growth.

You're Acquiring Low-Quality Leads

Low CAC often means you're targeting prospects who are cheap to acquire because they're not truly qualified. This creates what we call a "leaky bucket"—leads flow in, but very few convert into revenue.

Common symptoms of the leaky bucket syndrome:

Opportunity-to-close rates below industry benchmarks

Extended, resource-intensive sales cycles

High early-stage churn

Low customer lifetime value

Discrepancy between MQLs and SQLs

You might celebrate pipeline growth while sales struggles to close deals. The false economy of cheap leads becomes expensive very quickly when you account for wasted sales time, implementation costs, and customer success resources spent on poor-fit accounts.

You're Leaving Market Share on the Table

In the rare scenario where your market truly does have structurally lower acquisition costs than competitors, maintaining artificially low CAC is strategic malpractice.

If you can profitably acquire customers at 2x your current CAC—and still maintain healthy LTV:CAC ratios and acceptable payback periods—you should be increasing spend to capture as much market share as possible.

Markets reward aggressive, intelligent expansion. Leaving that opportunity untapped allows competitors to fill the void.

Framework: Rethinking How You Set CAC Targets

Most B2B SaaS companies set CAC targets backward. Finance picks an arbitrary LTV:CAC ratio, applies it universally across all customer segments, and expects marketing to hit it regardless of competitive realities.

This approach fails because it ignores three critical variables:

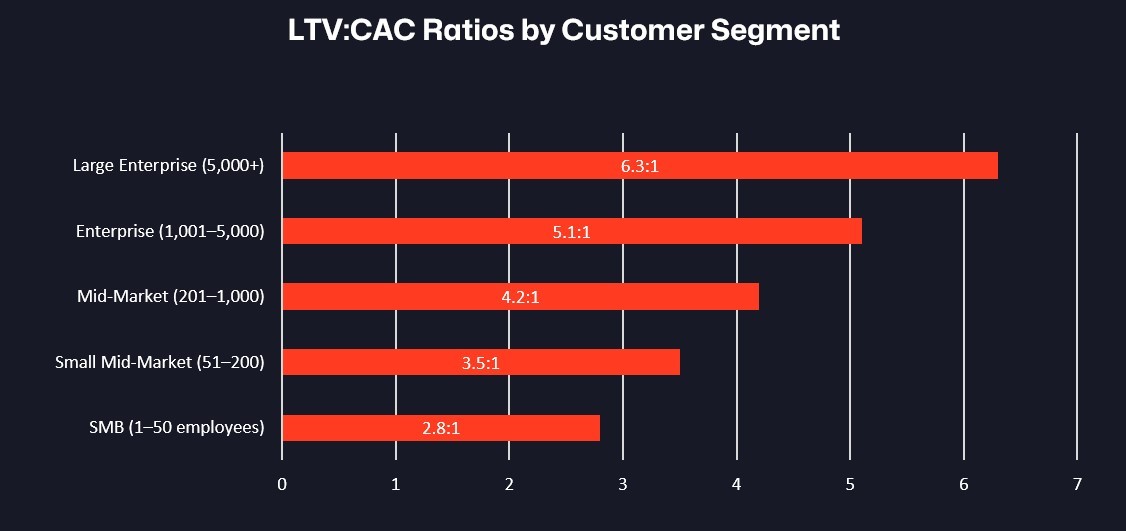

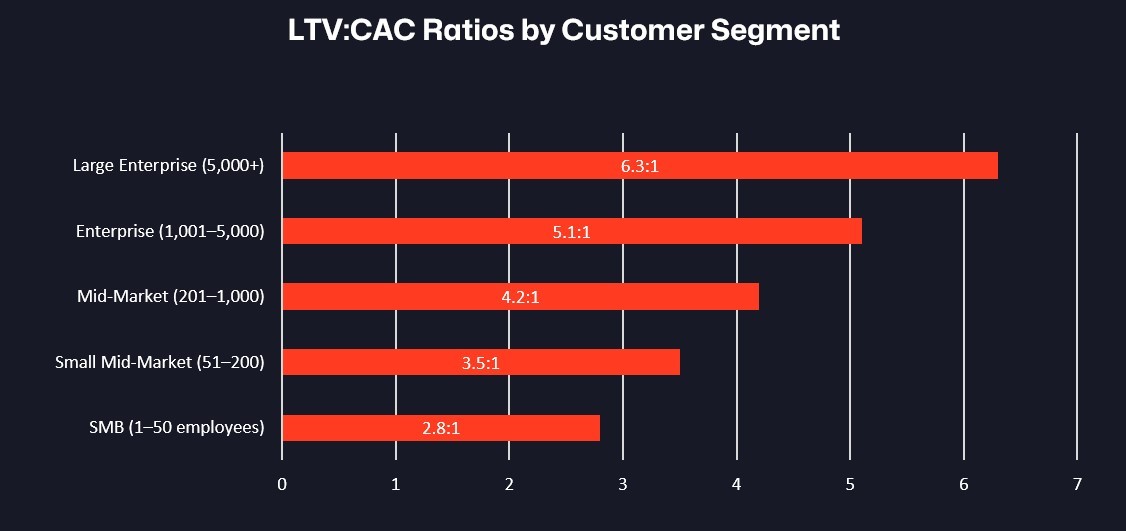

1. Not all customers deliver the same economic value

A 5,000-employee enterprise customer with a $200K ACV and 5-year retention profile deserves a higher CAC investment than a 50-employee SMB with a $10K ACV and 2-year retention. Yet most companies apply the same 3:1 or 4:1 LTV:CAC ratio to both.

This creates systematic underinvestment in high-value segments and potential overinvestment in low-value ones.

2. Competitive dynamics dictate market pricing

Your theoretical CAC ceiling is irrelevant if competitors are willing to outspend you to win deals. In competitive markets, the cost to acquire customers tends to stabilize at an equilibrium point where everyone is paying roughly the same amount for the same quality of lead.

If your targets are significantly below market benchmarks, you're not being efficient—you're forfeiting market share.

3. CAC optimization requires different strategies by motion and vertical

Product-led growth motions with high-volume, low-touch conversions require different CAC strategies than enterprise sales-led motions with long cycles and heavy sales involvement. Similarly, regulated verticals like financial services and healthcare often have higher acquisition costs due to longer education cycles and risk aversion.

A one-size-fits-all CAC target ignores these realities. See LTV optimization strategies.

The Right Way to Think About CAC Targets

Instead of starting with an arbitrary LTV:CAC ratio and forcing it onto every customer segment, work backward from three data points:

Historical customer economics by cohort – What has each segment actually delivered in ACV, LTV, retention, and expansion?

Competitive market benchmarks – What are competitors spending to win similar deals in your category?

Strategic growth priorities – Which segments align with your long-term market positioning and expansion goals?

Once you have this foundation, you can establish cohort-specific CAC ceilings that balance profitability with competitive positioning.

The goal isn't to minimize CAC—it's to maximize profitable growth by investing the right amount in the right customer segments.

The Playbook to Establish Realistic CAC Targets and Leverage Them for Growth

Once you shift from "How do we cut CAC?" to "What's the right CAC to win competitively?", you need a systematic approach to establish and operationalize those targets.

Here's the step-by-step playbook to determine realistic CAC targets and use them to capture more market share.

Step 1: Cohortize Prospects and Establish Baseline CAC

Not all prospects are equally valuable, so they don't deserve the same CAC investment.

Start by segmenting your customer base into cohorts based on:

Company size – Use employee bands: 1-50, 51-200, 201-500, 501-1,000, 1,001-5,000, 5,001-10,000, 10,000+

Vertical and complexity – Different industries have different buying behaviors, implementation requirements, and price sensitivities

Go-to-market motion – Product-led growth (PLG), sales-led growth (SLG), PLG-assist, or enterprise-only

Once you've defined cohorts, pull historical acquisition data and calculate:

Blended CAC – Total marketing and sales costs divided by new customers acquired

CAC by channel – Paid search, paid social, content/SEO, partnerships, events

CAC by cohort – What did it actually cost to acquire customers in each segment?

This baseline shows you where you are today. The next step shows you where you should be.

Step 2: Calculate Realistic CAC Targets Using LTV Data

Finance teams often pressure marketers to reduce CAC without providing a data-driven rationale for why a specific target makes sense.

The reality is that CAC targets should be based on the actual economic value each cohort delivers—not on arbitrary ratio mandates.

For each cohort, pull the data to answer:

What is our average contract value (ACV)? – First-year revenue

What is our customer lifetime value (LTV)? – Total revenue over the customer relationship, accounting for expansion and churn

What is our payback period? – How long does it take to recoup acquisition costs?

Once you have this data, work backward to establish allowable CAC.

Example: Mid-Market SaaS Company

Let's say you're targeting companies with 501-1,000 employees:

ACV: $50,000

Average customer lifetime: 4 years

Annual expansion rate: 15%

Total LTV: $230,000 ($50K + $57.5K + $66.1K + $76K)

Target LTV:CAC ratio: 3:1

Allowable CAC: $76,666

If your current CAC for this cohort is $25,000, you have $51,000 in headroom to increase spend and capture more market share.

But here's the critical insight: if your competitors are spending $60,000 to acquire these same customers, and you're spending $25,000, you're not winning on efficiency—you're losing competitive deals because you're underfunding the channels, content, and sales support needed to win.

Finance teams often assume a 4:1 LTV:CAC ratio is necessary for profitability. In reality, that ratio is arbitrary. If your gross margins are 80%+ (common in SaaS) and your payback period is under 18 months, a 3:1 ratio can be highly profitable while still allowing you to compete aggressively for market share.

The playbook in action:

For each cohort, calculate your allowable CAC ceiling. Compare it to your current spending. If there's a gap, you have an opportunity to increase investment strategically.

If your current CAC exceeds your allowable ceiling, the issue isn't CAC—it's conversion efficiency. Focus on optimizing your funnel, improving lead quality, or shortening sales cycles before increasing spend.

Step 3: Use Organic Channels to Create Competitive Moat—Then Invest in Paid to Scale

There's one legitimate way to sustainably achieve lower CAC than competitors: build a superior organic presence and optimize your buyer journey to convert prospects more efficiently.

If you've invested in SEO, content marketing, community building, and brand awareness, you can acquire customers at a lower cost per lead (CPL) while maintaining strong conversion rates. This isn't a growth hack—it's a durable competitive advantage.

But here's where most companies make a strategic mistake: they use their organic efficiency to keep CAC low rather than leveraging it to capture more market share.

The right strategy:

If your organic channels generate qualified leads at a lower cost than competitors, you have two compounding advantages:

Lower blended CAC – Your organic pipeline reduces the per-customer cost across all channels

More budget headroom for paid – You can afford to bid more aggressively on paid channels while maintaining healthy unit economics

Example:

Company A and Company B both target the same customer cohort with an allowable CAC of $60,000.

Company A has no organic presence and relies entirely on paid channels. They spend $60,000 per customer and operate at their ceiling.

Company B generates 40% of new customers through organic channels at $15,000 CAC. Their blended CAC is $39,000 (60% paid at $60K + 40% organic at $15K).

Company B now has two strategic options:

Maintain lower CAC and enjoy higher profit margins

Increase paid spend to $80,000 per customer while keeping blended CAC at $56,000—still below ceiling

Option 2 is the growth lever. By investing organic efficiency gains back into paid acquisition, Company B captures significantly more market share while Company A remains constrained by their CAC ceiling.

This is how best-in-class B2B SaaS companies use CAC strategically: they build organic flywheels that create financial headroom to outspend competitors on paid channels, capturing both high-efficiency organic deals and competitive paid deals their rivals can't afford to chase.

Data Visualizations: Understanding CAC as a Strategic Metric

Graph 1: CAC vs. Competitor CAC Over Time

When your CAC stays flat while competitor spending rises, you're not winning efficiency—you're ceding market share.

Graph 2: LTV:CAC Ratios Across Customer Segments

LTV:CAC ratio improves as you move upmarket—justifying higher acquisition spend on enterprise segments.

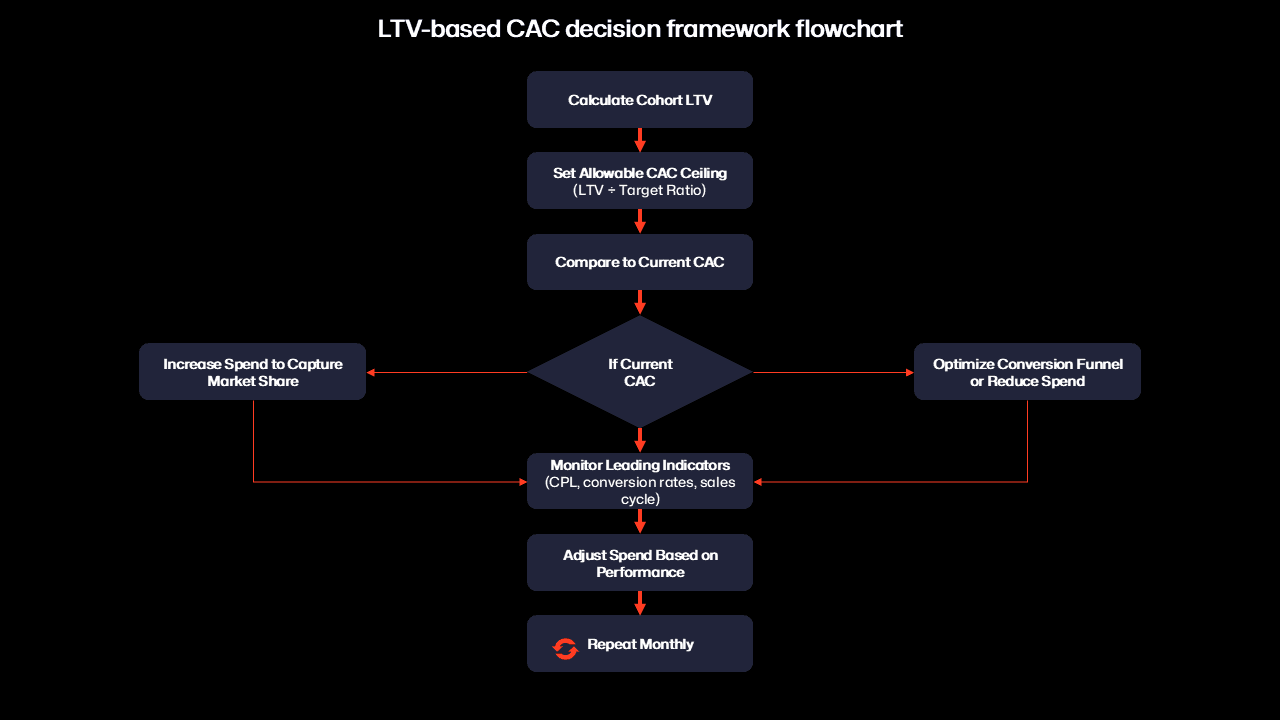

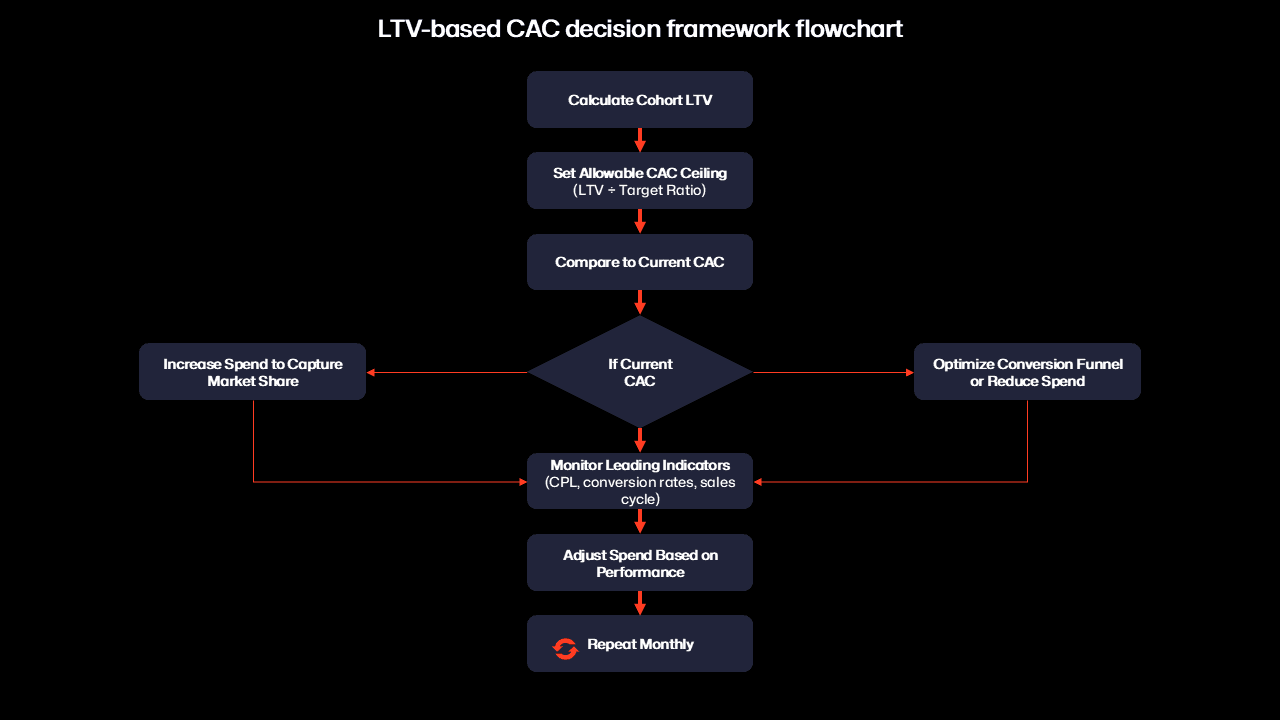

Graph 3: CAC Optimization Process Flowchart

Caption: A systematic approach to CAC optimization: align spending with cohort economics, then iterate based on performance data.

Case Examples: CAC Strategy in Action

Case 1: Mid-Market SaaS Company Increases CAC to Win Market Share

Company Profile:

Industry: Project management software

Target market: 201-1,000 employee companies

Historical CAC: $8,000

ACV: $30,000

LTV: $120,000

The Challenge: Finance pressured marketing to keep CAC below $10,000 to maintain a 12:1 LTV:CAC ratio. Marketing consistently underspent budget and missed pipeline targets.

The Strategy Shift:

Recalculated allowable CAC using a more realistic 4:1 LTV:CAC target: $30,000

Increased paid media budget by 200% to capture more in-market demand

Expanded into premium channels (LinkedIn, G2 sponsored listings, industry events)

The Results:

CAC rose to $18,000 (still below ceiling)

Pipeline grew 180% year-over-year

Market share increased from 8% to 14% in target segment

Payback period remained under 12 months

Key Takeaway: By treating CAC as a growth lever rather than a cost to minimize, the company aggressively captured market share while maintaining strong unit economics.

Case 2: Enterprise SaaS Refines CAC Targets by Vertical

Company Profile:

Industry: Compliance software

Target market: Financial services and healthcare verticals

Blended CAC: $45,000

The Challenge: Blended CAC targets obscured massive variance between verticals. Financial services deals took 18 months to close and required extensive sales support, while healthcare deals closed in 9 months with lighter touch.

The Strategy Shift:

Segmented CAC tracking by vertical

Financial services allowable CAC: $75,000 (LTV: $450,000)

Healthcare allowable CAC: $40,000 (LTV: $200,000)

Reallocated spend to reflect vertical economics

The Results:

Financial services CAC increased to $65,000—still profitable but far more competitive

Healthcare CAC decreased to $35,000 through conversion optimization

Overall customer acquisition volume increased 40%

Sales team closed deals faster with better-qualified leads

Key Takeaway: Cohort-specific CAC targets allow you to invest more in high-value segments while optimizing efficiency in others.

Conclusion: Stop Chasing Low CAC, Start Optimizing for Growth

The B2B SaaS companies winning market share today aren't the ones with the lowest CAC—they're the ones with the most strategic CAC.

Low CAC is not inherently good. High CAC is not inherently bad.

What matters is whether your CAC aligns with cohort economics, competitive realities, and growth objectives.

Here's what that looks like in practice:

Segment prospects by company size, vertical, and complexity

Calculate realistic CAC ceilings based on LTV and payback expectations

Align sales, marketing, and finance on cohort-specific investment strategies

Track leading indicators to catch inefficiencies before they compound

Run disciplined experiments to expand into new channels and cohorts

When you reframe CAC from a cost center to a growth lever, you unlock the ability to capture market share aggressively, win competitive deals, and build compounding revenue that competitors can't easily replicate.

The market doesn't reward the cheapest acquisition strategy. It rewards the smartest one.

Ready to Build a Smarter CAC Strategy?

Most SaaS finance teams treat CAC as a number to minimize. The companies winning market share treat it as a strategic allocation framework. The difference isn't subtle—it's the gap between ceding territory to competitors and capturing dominant market position while maintaining healthy economics. The challenge is that optimizing CAC requires sophisticated marketing intelligence infrastructure most companies lack: cohort-level tracking, competitive benchmarking, LTV modeling, and channel attribution that actually works.

At Blend, we help B2B SaaS companies build CAC strategies grounded in reality, not arbitrary ratios. We integrate the LTV optimization strategies that create financial headroom with the budget allocation frameworks that deploy capital intelligently across cohorts and channels. If your finance team is pressuring you to cut CAC without understanding competitive dynamics, let's build your growth lever.

Most B2B finance teams pressure marketing to cut customer acquisition costs. It sounds logical—spend less, improve margins, scale efficiently. But this mindset rests on a dangerous assumption: that cheaper is always better.

The reality? Chasing artificially low CAC doesn't just limit growth—it hands your market share to competitors who are willing to pay what it actually costs to win.

In competitive B2B markets, only about 5% of your total addressable market is actively evaluating solutions at any given time. When you underspend on acquisition, you're not just missing opportunities—you're allowing competitors to capture in-market prospects who won't resurface for years due to long contract cycles and high switching costs.

This creates a compounding disadvantage. Every prospect your competitor wins today represents years of lost revenue, reduced market share, and a stronger competitive moat you'll have to overcome later.

The question isn't "How low can we push CAC?" It's "What's the right CAC to maximize sustainable growth and market capture?"

Let's reframe customer acquisition cost from a metric to minimize into a strategic lever for competitive advantage.

Why Low CAC Can Be a Red Flag

If your CAC is significantly lower than your competitors', you might think you've discovered a competitive advantage. More often, it's a warning signal.

In mature, competitive markets, CAC tends to stabilize as competitors copy effective tactics and bid up the cost of high-intent channels. When everyone is competing for the same finite pool of in-market buyers, acquisition costs naturally reach equilibrium.

A suspiciously low CAC usually indicates one of three scenarios:

You've Found a Growth Hack (That Won't Last)

Growth hacks are temporary arbitrage opportunities—untapped channels, underpriced platforms, or novel tactics competitors haven't discovered yet. They work brilliantly until they don't.

The moment your competitors notice your tactic (and they will), they'll replicate it. Costs rise, efficiency drops, and you're back to market equilibrium. Andrew Chen's Law of Shitty Clickthroughs captures this perfectly: every marketing tactic declines in effectiveness over time as the market saturates.

Building a growth strategy on tactics that inherently degrade is a recipe for unsustainable growth.

You're Acquiring Low-Quality Leads

Low CAC often means you're targeting prospects who are cheap to acquire because they're not truly qualified. This creates what we call a "leaky bucket"—leads flow in, but very few convert into revenue.

Common symptoms of the leaky bucket syndrome:

Opportunity-to-close rates below industry benchmarks

Extended, resource-intensive sales cycles

High early-stage churn

Low customer lifetime value

Discrepancy between MQLs and SQLs

You might celebrate pipeline growth while sales struggles to close deals. The false economy of cheap leads becomes expensive very quickly when you account for wasted sales time, implementation costs, and customer success resources spent on poor-fit accounts.

You're Leaving Market Share on the Table

In the rare scenario where your market truly does have structurally lower acquisition costs than competitors, maintaining artificially low CAC is strategic malpractice.

If you can profitably acquire customers at 2x your current CAC—and still maintain healthy LTV:CAC ratios and acceptable payback periods—you should be increasing spend to capture as much market share as possible.

Markets reward aggressive, intelligent expansion. Leaving that opportunity untapped allows competitors to fill the void.

Framework: Rethinking How You Set CAC Targets

Most B2B SaaS companies set CAC targets backward. Finance picks an arbitrary LTV:CAC ratio, applies it universally across all customer segments, and expects marketing to hit it regardless of competitive realities.

This approach fails because it ignores three critical variables:

1. Not all customers deliver the same economic value

A 5,000-employee enterprise customer with a $200K ACV and 5-year retention profile deserves a higher CAC investment than a 50-employee SMB with a $10K ACV and 2-year retention. Yet most companies apply the same 3:1 or 4:1 LTV:CAC ratio to both.

This creates systematic underinvestment in high-value segments and potential overinvestment in low-value ones.

2. Competitive dynamics dictate market pricing

Your theoretical CAC ceiling is irrelevant if competitors are willing to outspend you to win deals. In competitive markets, the cost to acquire customers tends to stabilize at an equilibrium point where everyone is paying roughly the same amount for the same quality of lead.

If your targets are significantly below market benchmarks, you're not being efficient—you're forfeiting market share.

3. CAC optimization requires different strategies by motion and vertical

Product-led growth motions with high-volume, low-touch conversions require different CAC strategies than enterprise sales-led motions with long cycles and heavy sales involvement. Similarly, regulated verticals like financial services and healthcare often have higher acquisition costs due to longer education cycles and risk aversion.

A one-size-fits-all CAC target ignores these realities. See LTV optimization strategies.

The Right Way to Think About CAC Targets

Instead of starting with an arbitrary LTV:CAC ratio and forcing it onto every customer segment, work backward from three data points:

Historical customer economics by cohort – What has each segment actually delivered in ACV, LTV, retention, and expansion?

Competitive market benchmarks – What are competitors spending to win similar deals in your category?

Strategic growth priorities – Which segments align with your long-term market positioning and expansion goals?

Once you have this foundation, you can establish cohort-specific CAC ceilings that balance profitability with competitive positioning.

The goal isn't to minimize CAC—it's to maximize profitable growth by investing the right amount in the right customer segments.

The Playbook to Establish Realistic CAC Targets and Leverage Them for Growth

Once you shift from "How do we cut CAC?" to "What's the right CAC to win competitively?", you need a systematic approach to establish and operationalize those targets.

Here's the step-by-step playbook to determine realistic CAC targets and use them to capture more market share.

Step 1: Cohortize Prospects and Establish Baseline CAC

Not all prospects are equally valuable, so they don't deserve the same CAC investment.

Start by segmenting your customer base into cohorts based on:

Company size – Use employee bands: 1-50, 51-200, 201-500, 501-1,000, 1,001-5,000, 5,001-10,000, 10,000+

Vertical and complexity – Different industries have different buying behaviors, implementation requirements, and price sensitivities

Go-to-market motion – Product-led growth (PLG), sales-led growth (SLG), PLG-assist, or enterprise-only

Once you've defined cohorts, pull historical acquisition data and calculate:

Blended CAC – Total marketing and sales costs divided by new customers acquired

CAC by channel – Paid search, paid social, content/SEO, partnerships, events

CAC by cohort – What did it actually cost to acquire customers in each segment?

This baseline shows you where you are today. The next step shows you where you should be.

Step 2: Calculate Realistic CAC Targets Using LTV Data

Finance teams often pressure marketers to reduce CAC without providing a data-driven rationale for why a specific target makes sense.

The reality is that CAC targets should be based on the actual economic value each cohort delivers—not on arbitrary ratio mandates.

For each cohort, pull the data to answer:

What is our average contract value (ACV)? – First-year revenue

What is our customer lifetime value (LTV)? – Total revenue over the customer relationship, accounting for expansion and churn

What is our payback period? – How long does it take to recoup acquisition costs?

Once you have this data, work backward to establish allowable CAC.

Example: Mid-Market SaaS Company

Let's say you're targeting companies with 501-1,000 employees:

ACV: $50,000

Average customer lifetime: 4 years

Annual expansion rate: 15%

Total LTV: $230,000 ($50K + $57.5K + $66.1K + $76K)

Target LTV:CAC ratio: 3:1

Allowable CAC: $76,666

If your current CAC for this cohort is $25,000, you have $51,000 in headroom to increase spend and capture more market share.

But here's the critical insight: if your competitors are spending $60,000 to acquire these same customers, and you're spending $25,000, you're not winning on efficiency—you're losing competitive deals because you're underfunding the channels, content, and sales support needed to win.

Finance teams often assume a 4:1 LTV:CAC ratio is necessary for profitability. In reality, that ratio is arbitrary. If your gross margins are 80%+ (common in SaaS) and your payback period is under 18 months, a 3:1 ratio can be highly profitable while still allowing you to compete aggressively for market share.

The playbook in action:

For each cohort, calculate your allowable CAC ceiling. Compare it to your current spending. If there's a gap, you have an opportunity to increase investment strategically.

If your current CAC exceeds your allowable ceiling, the issue isn't CAC—it's conversion efficiency. Focus on optimizing your funnel, improving lead quality, or shortening sales cycles before increasing spend.

Step 3: Use Organic Channels to Create Competitive Moat—Then Invest in Paid to Scale

There's one legitimate way to sustainably achieve lower CAC than competitors: build a superior organic presence and optimize your buyer journey to convert prospects more efficiently.

If you've invested in SEO, content marketing, community building, and brand awareness, you can acquire customers at a lower cost per lead (CPL) while maintaining strong conversion rates. This isn't a growth hack—it's a durable competitive advantage.

But here's where most companies make a strategic mistake: they use their organic efficiency to keep CAC low rather than leveraging it to capture more market share.

The right strategy:

If your organic channels generate qualified leads at a lower cost than competitors, you have two compounding advantages:

Lower blended CAC – Your organic pipeline reduces the per-customer cost across all channels

More budget headroom for paid – You can afford to bid more aggressively on paid channels while maintaining healthy unit economics

Example:

Company A and Company B both target the same customer cohort with an allowable CAC of $60,000.

Company A has no organic presence and relies entirely on paid channels. They spend $60,000 per customer and operate at their ceiling.

Company B generates 40% of new customers through organic channels at $15,000 CAC. Their blended CAC is $39,000 (60% paid at $60K + 40% organic at $15K).

Company B now has two strategic options:

Maintain lower CAC and enjoy higher profit margins

Increase paid spend to $80,000 per customer while keeping blended CAC at $56,000—still below ceiling

Option 2 is the growth lever. By investing organic efficiency gains back into paid acquisition, Company B captures significantly more market share while Company A remains constrained by their CAC ceiling.

This is how best-in-class B2B SaaS companies use CAC strategically: they build organic flywheels that create financial headroom to outspend competitors on paid channels, capturing both high-efficiency organic deals and competitive paid deals their rivals can't afford to chase.

Data Visualizations: Understanding CAC as a Strategic Metric

Graph 1: CAC vs. Competitor CAC Over Time

When your CAC stays flat while competitor spending rises, you're not winning efficiency—you're ceding market share.

Graph 2: LTV:CAC Ratios Across Customer Segments

LTV:CAC ratio improves as you move upmarket—justifying higher acquisition spend on enterprise segments.

Graph 3: CAC Optimization Process Flowchart

Caption: A systematic approach to CAC optimization: align spending with cohort economics, then iterate based on performance data.

Case Examples: CAC Strategy in Action

Case 1: Mid-Market SaaS Company Increases CAC to Win Market Share

Company Profile:

Industry: Project management software

Target market: 201-1,000 employee companies

Historical CAC: $8,000

ACV: $30,000

LTV: $120,000

The Challenge: Finance pressured marketing to keep CAC below $10,000 to maintain a 12:1 LTV:CAC ratio. Marketing consistently underspent budget and missed pipeline targets.

The Strategy Shift:

Recalculated allowable CAC using a more realistic 4:1 LTV:CAC target: $30,000

Increased paid media budget by 200% to capture more in-market demand

Expanded into premium channels (LinkedIn, G2 sponsored listings, industry events)

The Results:

CAC rose to $18,000 (still below ceiling)

Pipeline grew 180% year-over-year

Market share increased from 8% to 14% in target segment

Payback period remained under 12 months

Key Takeaway: By treating CAC as a growth lever rather than a cost to minimize, the company aggressively captured market share while maintaining strong unit economics.

Case 2: Enterprise SaaS Refines CAC Targets by Vertical

Company Profile:

Industry: Compliance software

Target market: Financial services and healthcare verticals

Blended CAC: $45,000

The Challenge: Blended CAC targets obscured massive variance between verticals. Financial services deals took 18 months to close and required extensive sales support, while healthcare deals closed in 9 months with lighter touch.

The Strategy Shift:

Segmented CAC tracking by vertical

Financial services allowable CAC: $75,000 (LTV: $450,000)

Healthcare allowable CAC: $40,000 (LTV: $200,000)

Reallocated spend to reflect vertical economics

The Results:

Financial services CAC increased to $65,000—still profitable but far more competitive

Healthcare CAC decreased to $35,000 through conversion optimization

Overall customer acquisition volume increased 40%

Sales team closed deals faster with better-qualified leads

Key Takeaway: Cohort-specific CAC targets allow you to invest more in high-value segments while optimizing efficiency in others.

Conclusion: Stop Chasing Low CAC, Start Optimizing for Growth

The B2B SaaS companies winning market share today aren't the ones with the lowest CAC—they're the ones with the most strategic CAC.

Low CAC is not inherently good. High CAC is not inherently bad.

What matters is whether your CAC aligns with cohort economics, competitive realities, and growth objectives.

Here's what that looks like in practice:

Segment prospects by company size, vertical, and complexity

Calculate realistic CAC ceilings based on LTV and payback expectations

Align sales, marketing, and finance on cohort-specific investment strategies

Track leading indicators to catch inefficiencies before they compound

Run disciplined experiments to expand into new channels and cohorts

When you reframe CAC from a cost center to a growth lever, you unlock the ability to capture market share aggressively, win competitive deals, and build compounding revenue that competitors can't easily replicate.

The market doesn't reward the cheapest acquisition strategy. It rewards the smartest one.

Ready to Build a Smarter CAC Strategy?

Most SaaS finance teams treat CAC as a number to minimize. The companies winning market share treat it as a strategic allocation framework. The difference isn't subtle—it's the gap between ceding territory to competitors and capturing dominant market position while maintaining healthy economics. The challenge is that optimizing CAC requires sophisticated marketing intelligence infrastructure most companies lack: cohort-level tracking, competitive benchmarking, LTV modeling, and channel attribution that actually works.

At Blend, we help B2B SaaS companies build CAC strategies grounded in reality, not arbitrary ratios. We integrate the LTV optimization strategies that create financial headroom with the budget allocation frameworks that deploy capital intelligently across cohorts and channels. If your finance team is pressuring you to cut CAC without understanding competitive dynamics, let's build your growth lever.

Written by

Dylan Fields

When not hard at work, Danny can be found enjoying the outdoors, seeing live music, and exercising. Danny is passionate about data-informed decisions and strongly believes in implementing cohesive measurement frameworks to ensure all media is accountable for driving business outcomes. Throughout his career, he has developed full-funnel media strategies to drive both Brand Awareness and Growth objectives. He also loves ideating and activating first-to-market opportunities for clients to help brands stay innovative and at the forefront of their vertical.

More articles by

Dylan Fields

You might also like…

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298

+91 6366 298 298